Savvy, backed by our shareholder the Public Investment Fund, is committed to driving long-term growth and innovation in games and esports through acquisitions, investments, and commercial ventures.

By expanding our portfolio and growing the games and esports ecosystem, we are shaping the future of the sector on a global scale.

0%

0%

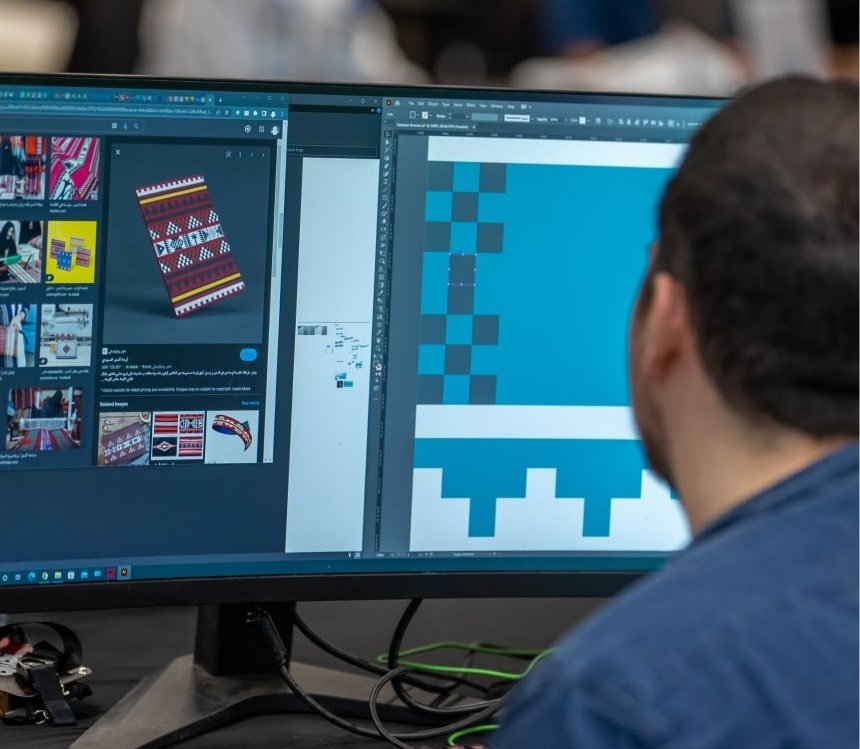

Steer Studios is a game development studio headquartered in Riyadh, Saudi Arabia. Part of Savvy Games Group, Steer is on a mission to create groundbreaking game experiences for players around the world.

Through EFG’s role as the operator of the Esports World Cup and other significant esports events, Savvy is transforming Saudi Arabia into a global esports hub.

Savvy has formalized a number of partnerships and collaborations with influential players in the industry to attract international games studios and companies to Saudi Arabia and create opportunities for domestic talent.

Inspire play, every day.

Scopely is a leading global interactive entertainment and video game company, home to top-grossing, award-winning franchises, including MONOPOLY GO!, Stumble Guys, Star Trek™ Fleet Command, YAHTZEE® With Buddies, and more.

We create worlds beyond gameplay where players and fans become a community.

EFG partners with developers, publishers, brands, and media to deliver unique experiences that strengthen games culture and build gamer communities.

A SPONSOR of the most decorated football team in Asia.

In June 2023, Savvy became a key partner of Al Hilal Saudi Football Club. This collaboration reflects our shared commitment to excellence. Together, we aim to inspire fans across Saudi Arabia and beyond, bridging people’s passions for football and games.